TowerWatch #6: Movement Soon

Welcome to the sixth edition of TowerWatch, a weekly newsletter from BlockTower that focuses on cutting through the noise in the cryptomarkets.

We have one purpose: be useful.

Three things you should know:

One: The Danger of a Sophisticated Market

We’ve talked before about the recent growth of the cryptocurrency derivatives market, and I’m sorry to say we are going to keep talking about it…because the market keeps growing. Last week we saw Bakkt launch a new options product and OkEx announce an options platform coming in January. This comes only a month after the CME revealed the specification of their Bitcoin options contract. In just a few months, we’ve gone from one major options venue (Deribit) to four.

The sophistication of this market is increasing pretty quickly. We have products like Binance margin, where one can easily obtain leverage to trade illiquid altcoins and innovative platforms like FTX with leveraged tokens (similar to leveraged ETFs). We’ve also seen the growth of institutional and retail platforms like BlockFi, Genesis and Celsius that are facilitating a robust lending market.

All of this development begs the question: what are the downsides here? Well, there are a few.

First, the introduction of highly levered derivatives products has made market manipulation a lucrative opportunity. Many derivatives platforms have more liquidity than their underlying reference exchanges. This makes index manipulation a tempting opportunity for individuals that believe in their ability to trigger stops and cause liquidation (often causing a cascade effect that can be played). In August of this year, we actually saw this play out via a large sell on Bitstamp (the least liquid BitMEX index constituent) that caused over $250mm in liquidations and sharp 10% decline in price.

The average leverage on BitMEX is usually between 20 - 30x even though Bitcoin often comes in at over 100% realized vol…

Second, derivatives pose serious implications for the overall security of Bitcoin. As the market grows in size, it becomes more financially feasible to perform a 51% attack on the Bitcoin network. The notional value of the derivatives market could one day exceed the value of all Bitcoin in existence, so it’s possible that a malicious individual could put on a large short position (say, 10% of the market value of Bitcoin) that would profit tremendously if the Bitcoin network was attacked. If the individual believed that an attack would send Bitcoin price down ~30%, they could spend 3% of the total value of Bitcoin setting up the requisite infrastructure for the attack. At current prices, this would be $3bn that an attacker could spend on a 51% attack.

This attack is somewhat confined to PoW systems. If you attempted this attack with a PoS system, you would lose unless your short was >51% of the value of the network — a large undertaking.

Third, we are seeing some initial worries about credit risk in the loan space. Miners have been putting up Bitcoin as collateral for working capital from the major cryptocurrency loan desks. Going into the halving, the estimated cost of production for Bitcoin is ~6,500. After the halving, this will increase to ~13.0k all else held equal. This could induce some smaller miners to default on their loans if Bitcoin price is substantially below $13,000 at the time of halving.

The introduction of loan facilities that focus directly on Bitcoin lending has increased the potential risk for a system-wide failure. Now, it’s unlikely that anything goes seriously wrong here because the size of the market is quite small, but it’s still worth noting that weak price action into the halving could cause some adverse effects.

Actionable takeaway: The sophistication of the products in the cryptocurrency markets is higher than the individual sophistication of the players in the cryptocurrency markets. This is causing meaningful dislocations that savvy funds and individuals can take advantage of.

Two: Decentralized… Social Media?

Decentralized coordination is one of the major accomplishments of the cryptocurrency world. The Bitcoin whitepaper introduced a novel way to ensure that N number of individuals (who have no reason to trust each other) come to consensus on the current state of a network (Bitcoin). This was a Herculean task, but the last 10 years of existence has proved it to be a fruitful one. The success of the Bitcoin network proved that there is a way to have a decentralized network coordinate individuals for the greater good.

Since then, we’ve seen different applications of this concept. Ethereum introduced another layer of complexity with the build out of smart contracts, and Tezos took us a step further by putting the concept of a self-amending / self-governing protocol into action. All of these developments are grand experiments in the realm of human coordination.

The early days of the internet was littered with protocols that determined how we as humans might interact with other. How chat would work (IRC), how data would be sent (TDP/UDP) and how email would work (SMTP). Since then, the internet has evolved away from direct use of simple protocols, to platforms that abstract away the underlying protocol and build their moats around their products. Platforms such as Facebook, Twitter and YouTube that have their own proprietary algorithms, specialized UIs and deep reserves of user data.

For a while, this was great. Individuals got these fantastic services at seemingly no cost. Over the last few years though, it’s become more clear that these platforms have major issues. Complications such as censorship and abuse of data arose, muddying the waters and highlighting the issues of a centralized internet.

On Wednesday, Jack Dorsey set twitter alight when he tweeted out his plans to have Twitter fund the development of an open protocol for social media through a project called BlueSky. Jack articulated many of the current issues with our platform based internet, and called for a focus on open source social media. We should be building protocols, not platforms, according to Jack.

Protocols and platforms are of course inextricably intertwined. Both are just essentially a set of rules for what individuals see, what they can say, and how they can and should express themselves. In many ways, protocols are akin to individual human cultures — a set of rules decided on by the population, a common understanding of how to interact with one another. Taking a step further, platforms are similar to state enforced culture (think Maoism) whereas protocols are more similar to unencumbered and organic culture (think 1600’s America). One is closed, centrally enforced form of communication, the other is a open and free form of communication.

All of this ties back into cryptocurrency. How do you get individuals to govern a platform together? How do you incentivize individuals to act in the best interest of the platform, and not act selfishly? Many in the cryptocurrency world are working on this. The entire concept of tokens associated with a blockchain is a concept based on economic coordination. It would be surprising to see a open source social media eschewing all forms of tokenized economic coordination.

This particular development is important to pay attention to. There is now a significant amount of mindshare dedicated to understanding the current issues with the state of the internet, and based on the problem set it’s likely that the winner(s) will come from the world of crypto.

Three: The Woes of Experimentation

MakerDAO had a simple attack articulated by Micah Zoltu on Medium earlier this week.

Here’s the gist of the attack:

The governance system can call a wide variety of internal functions that allow the governors to do just about whatever they want. Governance is a fairly simple “stake the leader” system, where you stake your MKR on the contract that you want to have control over the system, and the contract with the most staked MKR is given that control. Since the current executive contract (AKA: executive proposal) has about 80,000 MKR staked on it, the naive cost of doing just about whatever you want to the Maker contracts is about 80,000 MKR, or about 41M USD.

Aquire 80,000 MKR through whatever means possible.

Create an executive contract that is programmed to transfer all collateral from Maker to you.

Immediately (in the same transaction) vote on the contract.

Immediately (in the same transaction) activate the contract.

Ride off into the sunset with 340M USD worth of ETH (don’t bother going back for your MKR, it will be worthless after this).

This is incredibly profitable (8x ROI), but it is expensive to execute. Luckily, we can knock the cost of the attack down to 50% of that by simply being patient!

Remember above how we described the way the current voting system works is that the executive contract with the most votes is the one with all the control? Anytime a governance vote is proposed, there is a time period over which MKR stake migrates from the old executive contract to the new one.

This never happens all at once, it usually happens over time as individuals migrate their votes forward. There will be a point in time where that 80,000 actively participating MKR will be split between two executive contracts, with each having approximately 40,000 MKR in it. A good script kiddie can easily time a transaction such that it lands right when the MKR is distributed optimally between the two contracts and execute the above attack at that time, only costing some amount over 40,000 MKR (~20M USD).

Basically, the Maker team believe the attack was unlikely and unknown, so they decided to sacrifice security for speed (allowing executive contract updates to pass immediately). The attack itself could be easily mitigated by introducing a delay for executive contracts — unfortunately the Maker teams chosen delay was 0 seconds.

After Micah’s articulation of the attack went viral, the Maker team quickly responded by upping the dispute time to 24 hrs, effectively shutting down any possibility of an effective execution of the attack.

Why this matters: All of this just goes to show that people forget that the entirety of this weird, wonderful ecosystem is an experiment. There is rarely anything in this market that works perfectly, despite individuals and companies often acting like there is and ignoring the overarching risks in favor of easy day to day interactions. We’re not saying that this is wrong, but rather that investment into the cryptocurrency requires constant diligence! It’s not enough to just park your money and believe.

Things Happen:

General

The European Central Bank hopes to get "ahead of the curve" on stablecoins

Asia’s Grayscale? Two new bitcoin trust products get launched, with Coinbase as custodian

‘New Risks’: Swiss Government Skeptical on Central Bank Digital Currency

Regulatory

Technical

Markets

As concerns over crypto credit bubble mount, miners appear to be particularly at risk

With hashes and hedges, power-hungry crypto miners court investors

Market Outlook:

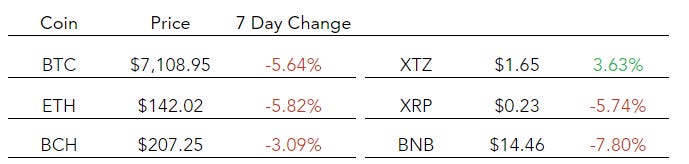

Bitcoin: We are looking much weaker than we did last week, now trading in the bottom quarter of the range. The market is still positioned quite short.

Bitcoin volatility has flattened out and found a floor of around ~3.25%, but IV’s are continuing to cruise down. The last major spike in volatility we saw was near the end of October off the heels of Xi Jinping’s announcement.

Term structure is still relatively steep, with the market pricing in some expected movement around the halving, but not much movement through the end of year.

Last year there was significant chatter about individuals and funds selling off for tax reasons, but we aren’t hearing much of that these days. The majority of market participants are up on the year, making it unlikely we see additional sell pressure from harvesting this year.

On our end, we’re watching out for a Bitcoin breakout. We’re seeing the tightest Bollinger bands since Mid-April before the beginning of the bull run. At these levels, vol is looking attractive, and we’d expect movement soon.

The key bullish scenario is a reclaiming of mid-range (7330), otherwise we’re looking at minor support levels of 6900 and 6500.

Overall Market: Correlations as a whole between Bitcoin and the broader market remain similar with BTC/ Bletchly Top 20 coming in at ~70% corr. Despite the overall market correlations, we some assets are exhibiting zero / negative correlations to BTC.

Even in a market as subdued as this one, we are seeing stellar performances from a select few coins. For example, TomoChain is up ~100% over the last two weeks. Tezos and Cosmos have posted gains of 28% and 20% respectively since Dec 1. We’re seeing continued rotation into “quality” projects as traders seem to be latching onto an emerging staking narrative.

What We’re Reading:

2019 has in many ways been the year of decentralized finance. Few people at the end of 2018 were talking about the potential for DeFi — but now, everyone is talking about it.

Decentralized finance has captured the imagination in no small part because it’s so easy to explain. You can get a loan without going to a bank. You can buy cryptocurrency without going to a centralized exchange. You can get exposure to the S&P without a brokerage account. The messaging hits home.

The most valuable applications built on Ethereum are now DeFi, but there is a still a long way to go. DeFi is still quite simple so there is a lot of room for growth. Most applications are fairly straightforward. Overcollateralized loans, decentralized exchanges, and simple synthetic products like DAI and sETH. If we’re to believe that DeFi could be the future of Ethereum, there’s going to need be a little more innovation.

In a great op-ed on Coindesk, Haseeb Qureshi hits on a few key points:

Collateralization ratios should fall overtime as less volatility collateral becomes available.

Applications will need to introduce greater diversity of synthetic assets to remain relevant — things such as synthetic USD and ETH don’t go far enough yet.

DeFi products should begin using historical data on individual users (based on some sort of shared identity) that would allow products to offer better rates to more trustworthy consumers.