TowerWatch #4: The Grind Down

Welcome to the fourth edition of TowerWatch, a weekly newsletter from BlockTower that focuses on cutting through the noise in the cryptomarkets.

We have one purpose: be useful.

One: Who’s Driving?

With the markets in trading down consistently over the last month (down ~22% from 9100 to 7100), it becomes tempting to search for a specific narrative. There have been rumors of Bitcoin miner capitulation, discussions about PlusToken liquidating assets, and an ongoing stream of negative regulatory announcements from the Chinese Govt. on cryptocurrencies. Generally headlines have been quite negative, and this has likely compounded the sell-off. Much of the news has come out of Asia, which has led individuals to believe that the recent sell-off is Eastern selling into Western bullishness.

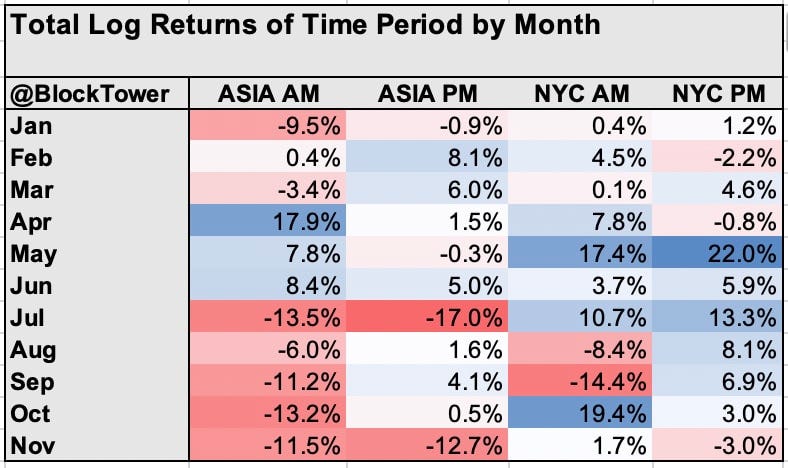

When you dive into the data this becomes a little bit more close. The table below divides up total returns per month by time zone. A cursory glance will tell you that Asia flipped bullish in April at the start of the rally and also flipped bear in Jul -- right at the top. Much of 2019 has been an Asia-driven market, and the distance between East/West actually seems to be strengthening (see Nov/Oct Asia AM vs NYC AM).

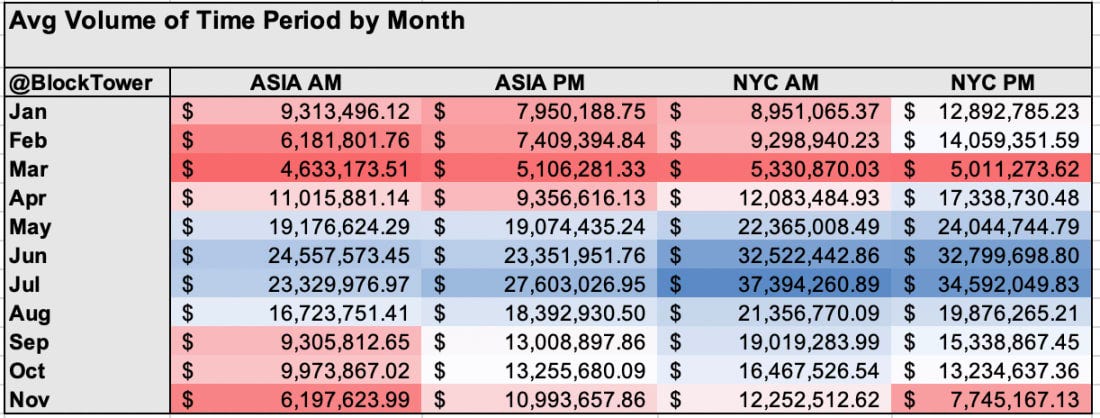

What’s interesting is that when you look at volumes, they are actually lower during Asian hours (note that these are spot volumes only, though).

This seems to jive with the theory that recently Asian traders have been really bearish, and are driving down prices. Recently, even Western “smart money” positioned short (chart courtesy of The Block).

Additionally, the breakdown of the rally in June coincides with the shuttering of PlusToken, a Ponzi scheme that accumulated ~200,000 BTC. According to individual researchers on-chain analytics, there seems to have been a distribution of 150,000 BTC over the last 5 months after the scam collapsed in June.

Then there is the mining theory. It goes like this:

Miners have been selling into the market in an outsized manner to the downturn, because they want to flush out additional hash power that is coming online.

Miners may be selling out their inventory for cash flow reasons. Difficulty squeezed out margins, so some miners are offloading BTC from their balance sheets.

The problems:

As it turns out there are a variety of new mining farms coming online in areas with lower electricity costs than current Chinese farms. It is a surefire assumption that Chinese miners are aware of the large US farms fundraising and in construction in at least the same level of detail as us, likely far greater.

Looking at miner flows to exchanges, it seems as though flows picked up through the summer, and have actually slowed down since Sept.

Final thoughts: It seems as though the most important market right now is the eastern market. Paying attention to traders in the east and what they think about the current market is key, as is tracking the large suppliers of BTC (miners/PlusToken). Of course, the real key is figuring out when to bet against the trend…

Two: Central Bank Digital Currencies (CBDC)

2019 seems to be the year of central bank digital currencies. From China to the EU, we’ve seen a spate of countries look into issuing a CBDC as a way to march fiat currencies into the future, and assert more control over monetary policy.

There has been quite a bit of back and forth of the topic, with some bankers being vehemently opposed to the idea, and others embracing the concept. On the pro side, Mark Carney (Governor of the BoE), advocated for the issuance of CBDC’s to reduce reliance on the U.S dollar. On the other hand, many have pointed out that introducing a CBDC could reduce deposits at banks, reducing overall money supply and harming economic growth.

Well, this week the Fed Chairman got in on the action. In a letter to Congress, Jerome Powell outlined where the Fed currently stands on the issues. The bottom line? The U.S is looking into it — but doesn’t foresee any implementation soon due to a few basic reasons:

Payment infrastructure is already robust in the United States so there is little reason to implement a CBDC. From a BIS survey earlier this year, it seems the main reason for introducing a CBDC is payment efficiency — something which Powell points out as unnecessary.

The Fed does not want to take away liquidity from the banking system, claiming that there is no good model for understanding what happens when the Fed itself becomes a consumer bank (which is fair!)

Why this matters: There are three types of digital currencies now:

Permissionless Currencies (Bitcoin)

Corporate Currencies (Libra)

State Currencies (CBDC)

The deep dive into digital currencies that central banks are taking is in no small part due to the threat of corporate currencies such as Libra presenting a threat to the management of monetary policy. If individuals in states begin using alternative currencies, then the role of central banks is great diminished. If it turns out that corporate currencies or permissionless currencies are actually easier to use, then central banks could find themselves unable to meaningful enforce economic policy.

Three: Growing Infrastructure

The building goes on! This past week has been busy for Fidelity Digital Assets. They not only secured the elusive Bitlicense from New York State, allowing them to offer their institutional-grade custody and execution services to New York residents, but are also close to onboarding their first exchange for execution are partnering with Galaxy Digital to provide custody for Galaxy’s new Bitcoin fund. Fidelity Digital Assets itself was established after 4.5 years of Fidelity testing the waters for institutional interest in digital assets. With $2.8 trillion in AUM, Fidelity is one of the largest companies involved in the digital asset space.

Despite falling prices in the second half of 2019, we’ve seen increased investment into the digital asset world from traditional organizations. Bakkt (an Intercontinental Exchange company) has announced a variety of different products, ranging from apps to options. The CME is introducing an options product, launching on January 13th. In September, SoFi built a way for its users to buy cryptocurrency directly from their mobile app and website. In August, Rakuten released a wallet that facilitated cryptocurrency purchases. All in all, 2019 has seen significant improvement to both retail and institutional on-ramps to the cryptocurrency world.

Why this matters: With increased access points, comes increased potential adoption. Humans tend to choose the path of least resistance. The more difficult it is to acquire cryptocurrency, the less likely individuals are to buy all else held equal.

This makes on-ramps into the cryptocurrency world key for widespread adoption. In a previous issue of TowerWatch, we discussed the outsized impact that Square has on the retail market due to name brand, large reach, ease of use and aggressive promotion of Bitcoin. The same holds true in the institutional world. For most traditional players to feel comfortable in the digital asset space, there needs to be products that act somewhat similarly to the traditional world

General News:

JPMorgan Tests Private Blockchain to Track Auto Dealer Inventory

Statechains, and Trading the Panopticon for Magical Internet Money

Regulatory News:

Technical News:

Capital Markets:

Bitcoin miner maker Canaan Creative raises $90 million in U.S. IPO

a16z, Paradigm back Compound's $25M Series A to integrate with crypto exchanges and brokers

Market Outlook:

General Outlook: Despite equities and the broader financial markets rallying, Bitcoin has been stuck in a rut. We broke through the previous support level of 6800 at Asia market open today, Funding is staying consistently negative, and we did not see too many long liquidations on the way down from 7300 —> 6700 indicating that the market is quite scared overall.

We’re now trading back above 7000, with funding rates going deeply negative on the way up (traders shorting into the rally).

Despite significant dollar moves, both realized volatility and implied volatility have remained low. This is because Bitcoin has stepped down consistently rather than crashing.

The key for trading this market right now is to remain patient, keep dry power and be hesitant in positioning. This is a market that could sharply reverse, or trade down significantly. Playing ranges seems to be unwise here.

Key Levels:

Resistance: 7260

Support: 6600, 6200

Overall Market: Supply constrained altcoins such as XTZ and SNX have outperformed in this market, but overall everything else in the market is trading down along with BTC.

What We’re Reading:

A brief on Consensus Mechanisms

One of the most important breakthroughs of Bitcoin was using Proof-of-Work in conjunction with a blockchain to prevent double spending. Since then many different types of consensus mechanisms have popped up trying to either improve on security, efficiency or both. To understand the future of the cryptocurrency world, it’s important to have a solid grasp on the variety of consensus mechanisms out there. With this in mind, let’s walk through a great primer put together by Jordan Clifford from Scalar Capital.

Jordan breaks down consensus mechanisms into two types:

Mining algorithms

Non-mining algorithms.

Mining Algorithms:

Proof of work.

PoW creates consensus in rounds known as blocks. Consensus participants are called miners or block producers. To create a new block requires solving a mathematical puzzle that is difficult to solve but easy to verify. This puzzle acts as an ongoing lottery for the right to append to the ledger. Proof of Work awards each valid block that is included a block reward, and for the first time, consensus is paid for.

Pros: Very simple and secure. Novel approach to Sybil resistance allowing open participation

Cons: So far economies of scale have resulted in centralization. Consumes large quantities of physical resources.

Notable Examples: Bitcoin, Ethereum (current), Litecoin, Monero, ZCash

Proof of Stake:

Building on the concept of proof of work, Proof of Stake aims to be faster, more environmentally friendly, and more amenable to sharding — the division of labor within subgroups of a network. For the privilege of producing a block, rather than solve a mathematical puzzle, block producers vote with their stake on the blocks they produce. In PoS, it is possible to create a schedule in advance resulting in quite fast block generation times.

Pros: Offers finality enabling sharding possibilities. Can offer fast block times.

Cons: More complex than PoW. Nothing at stake is a theoretical problem.

Notable Examples: Ethereum (future), Decred (hybrid PoW/PoS), Dfinity

Delegated Proof of Stake (dPoS)

Delegated Proof of Stake is a specialized form of PoS. The difference is that the majority of owners in dPoS are expected to delegate their responsibility. By limiting the number of participants, latency becomes less of a problem and consensus speeds up. If the delegates are severely limited in number, premium hardware system requirements may be expected. A limited number of block producers with top notch equipment would allow a network to run at higher throughput.

Pros: Faster consensus since latency is less of an issue; more throughput

Cons: Less decentralized

Notable Examples: EOS, BitShares, Tron

Proof of Space Time (PoST)

A clever alternative to PoW, is PoST. In PoW, miners expend energy trying to solve a hard mathematical puzzle. PoST awards block rewards to consensus participants at a rate proportional to the storage they have allocated for participation.

One of the most promising advantages of PoST is the possibility that it will remain more decentralized. A problem with PoW algorithms is that they require cutting edge specialized hardware to participate profitably. Application Specific Integrated Circuits (ASICs) are mandatory to mine Bitcoin.

Pros: Potentially ASIC resistant. More environmentally friendly than PoW

Cons: Unproven and complex. ASICs or HD farms could diminish benefit

Notable Examples: Chia, SpaceMesh

Non-mining consensus mechanisms:

Practical Byzantine Fault Tolerance (pBFT)

When parties are familiar with each other and cooperative, it can make sense to abandon PoW or PoS models, and use traditional consensus algorithms. One such algorithm is an off-shoot of the original BFT family of algorithms known as pBFT. pBFT was proposed in 1999 by two MIT researchers. It requires a lot of communication overhead between participants, so it is only practical for small groups.

Pros: Reliable consensus amongst known parties

Cons: Only supports small number of participants; not a trustless system due to users having to trust validators

Notable Examples: Hyperledger, Ripple, Stellar

Directed Acyclic Graphs (DAGs)

Requiring all participants to come to consensus within a certain period of time limits the throughput of a system. One novel approach is to not require a global consensus on regular intervals. Rather than batch transactions into blocks that are agreed on in a global manner, transactions are individually added to the history.

As transactions are added, they reference prior transactions, and that gives some confidence that the prior transactions are accepted. If enough transactions are chained together on top of a given transaction, it’s increasingly probable that the network will accept the original transaction.

Pros: Fast “confirmations” and high throughput

Cons: Unproven in practice. Suspect immutability.

Notable Examples: Iota, Byteball, Nano

Some food for thought: everything but Proof of Work is “unproven in practice”. Even proof of work has it’s major flaws such as centralization of mining power and energy usage. In the coming years, there will be many breakthroughs when it comes to efficient consensus mechanisms, and I believe that the cryptocurrency landscape will radically change as a result. Make it a point to document all new consensus algorithms and follow the projects that are attempting new, novel approaches. One of them may end up a winner….