Welcome to the 13th edition of TowerWatch, a newsletter from BlockTower aimed at cutting through the noise of crypto markets. We have one purpose: be useful.

Two things you should know:

One: The Halving Has Arrived

The Halving is a mythic event for the Bitcoin community. For those less acquainted with the term, the halving refers to the approximately once-every-four-years reduction of the daily Bitcoin emission rate. Currently, about 1800 Bitcoin a day are “mined” or “created” around ~$18m worth at current market rates, increasing the overall supply of Bitcoin. On May 12th, the emission rate will be cut in half, and only 900 Bitcoin will be produced a day moving forward.

When all is said and done, only 21 million Bitcoin will ever exist! It is currently the only major tradable asset with a true supply cap, helping Bitcoin retain purchasing power — especially poignant in world where issued currencies seem to be anything but scarce.

The halving is a constant reminder of the hard money characteristics of Bitcoin, and is a genius unintentional marketing event that historically drives individuals to take a closer look at the Bitcoin markets. Now, while it’s true that the halving has directed attention to Bitcoin it hasn’t always lead to price increases. There are a few dynamics at play here:

How much new money enters because of elevated interest?

What is the impact of a reduction in new supply?

Do miners sell inventory to cover future costs as revenue is projected to halve?

Do current holders have reasons for increasing market supply (selling more?)

All of these questions have different answers for each halving, and are too dynamic to model simply and effectively.

The most commonly debated point concerns the decrease in emission rates. The reduction in inflation rates tends to convince people that Bitcoin tautologically has to go up, because there is now less sell pressure from miners. While this may have been true in the past due to the large amount of emission relative to outstanding supply, the reality of the current situation is that there is regularly $1b in Bitcoin volume and a decrease of $9m of sell volume is negligible on a day to day basis. So from a pure supply side look, the halving doesn’t have a major impact.

Overtime however, this supply reduction becomes important. As Bitcoin supply is inelastic, stability of new demand combined with a reduction in new supply issuance would lead to a steady upwards drift on price (steady in theory, volatile in practice due to non-uniformity of supply & demand).

So now the missing puzzle piece here becomes new demand. Going into the halving, the data is showing us that there is in fact increased interest because of the halving itself. Search interest is currently at all-time highs for the term “Bitcoin halving.”

Source: Google Trends

Why this matters: While the reduction in supply is relatively negligible, the halving is a strong marketing tool for Bitcoin, and is clearly driving interest in Bitcoin from the broader population. The overarching narrative of the halving is especially powerful today. In stark contrast to central banks around the world revving up what is arguably the greatest monetary expansion experiment in history, Bitcoin will be actively reducing it’s supply emission. With much of the world staring down the barrel of potential inflation, currency crisis (such as in Lebanon) and global instability — this becomes an undeniably attractive opportunity to take a look at a truly scarce asset as a hedge.

Two: DeFi Outside Ethereum

Decentralized Finance has taken the cryptocurrency world by storm over the last two years, promising a world of bank free loans and questionable ways of accessing leverage. So far the majority of these systems have been built on Ethereum. Platforms such as MakerDAO, Compound, USDC, TrustToken, TokenSets, InstaDapp, Synthentix, Curve, Uniswap and hundreds of others currently make up the Ethereum DeFi ecosystem that now facilitates services like wallet infrastructure, lending, insurance, synthetic asset exposure, stable coins and decentralized exchanges.

High developer activity, large VC investments and millions in assets under management on Ethereum has earned the attention of other layer 1 protocols and dev teams in the space. DeFi is becoming a way for new layer ones (and old layer ones!) to prove their mettle. There are now initial forays into DeFi built on protocols outside of Ethereum. Protocols like Cosmos, Tezos, and Algorand devs are now jockeying for position as the best protocol for DeFi outside of Ethereum.

Bitcoin:

Atomic Loans, the startup that provides DeFi lending experience for BTC holders allows users to lock BTC in an on-chain escrow and take out DAI or USDC loans or lend out their DAI to earn interest. They raised a $2.45 million seed round led by Initialized Capital, with participation from ConsenSys, Morgan Creek Digital, and Bison Trails’ Joe Lallouz and Aaron Henshaw. The borrowing feature of the protocol is now open to the public, while the lending side is still being beta tested. - The Block

Tezos:

A group of Switzerland-based crypto firms have come together to launch “tzBTC” - a 1:1 bitcoin-backed token on the Tezos blockchain. The news was announced on Wednesday by the Bitcoin Association Switzerland, which monitors the tzBTC system. It said tzBTC gives holders the ability to interact with Tezos smart contracts while pegging to the value of bitcoin. - The Block

Cosmos:

Kava aims to be the de facto DeFi platform by providing a decentralized lending platform and stablecoins compatible with major crypto assets. The Kava platform has two types of tokens, the KAVA token and the USDX stablecoin. The KAVA token is the native token of the Kava blockchain and is integral in the security, governance and the mechanical functions of the platform. - Binance Research

Algorand:

Republic, the investing platform and technology services provider that enables inclusive investment access is building a digital security on the Algorand blockchain. Republic’s crowdfunding and private syndication arms have raised capital for over 170 startups in just three years, facilitating ~$67.5 million of investment last year alone. In addition, with nearly 500,000 users, Republic’s platform has quickly established itself as a pioneer in the growing private investment space. Republic’s partnership with Algorand will pioneer new ways for accredited and unaccredited investors to capture the upside of Republic’s Ecosystem by providing novel exposure through the proposed security. - Algorand Foundation

Why this matters: As Ethereum continues to gain adoption through DeFi, other platforms will continue to copy them. DeFi seems to be the stickiest early use case, largely due to allowing current market participants to speculate, and every upcoming protocol wants a piece of the action.

Things Happen:

Technical

Markets

Bitcoin miners made $412.5 million in revenue during April, new data indicates

Bitfinex Now Has a Derivatives Contract Offering Exposure to Bitcoin Dominance

Market Outlook:

Bitcoin: The big news of the week is Paul Tudor Jones (“PTJ”) – one of the most revered macro traders in history and a personal investing icon – publicly acknowledging in his May investor letter that Bitcoin is one of his top assets to benefit from the “Great Monetary Inflation” he sees on the horizon resulting from an “unprecedented expansion of every form of money unlike anything the developed world has ever seen.”

In his most recent note to investors, he discussed this looming great monetary inflation (something I’ve talked about in this letter many times) and pored over the set of assets he suspects will act best in this new normal. This analysis led him back to a handful of traditional inflation winners, but most surprisingly (to the rest of the world) to Bitcoin. So much so, that Tudor announced they have updated their offering memoranda for their Tudor BVI fund to disclose that Tudor may trade in Bitcoin futures, and will start with a percentage allocation in the “low single digits”.

Of course, the market reacted extremely positively to this news. Bitcoin shot up past $10,000 before retracing the move into Asian hours.

The impact of this news should not be understated for a few reasons:

Unlike previous traditional entrants such as RenTech and Soros who just announced intent to trade, PTJ wrote out a Long Bitcoin thesis in his recent investor letter, touching on many of the timely narratives this recent crisis has brought to the forefront.

With the thesis comes a blessing. Previously, many traditional investors at hedge funds risked ridicule for buying Bitcoin and may have even been structurally prevented from buying Bitcoin in the first place. With this “blessing” it may get easier for your average portfolio manager to be able to take a flyer out on Bitcoin.

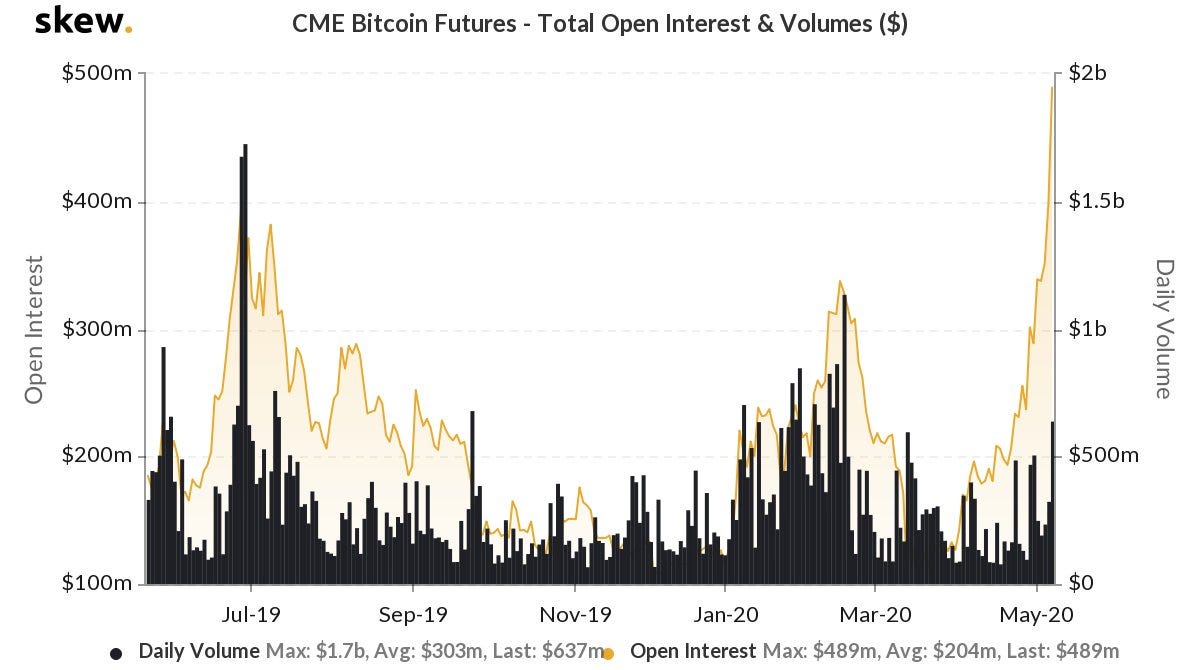

There are clues in the data that suggest traditional managers have already been accumulating Bitcoin. The chart below of CME Bitcoin futures open interest and volume is an interesting one — why is it that open interest has skyrocketed while volumes have remained flat? The simple explanation is that less people are trading, and more are holding long term positions.

Source: Skew.com

Overall, the market remains bid in a relatively healthy manner. The last time Bitcoin traded around the 10,000 level, open interest was more than 2x and the futures curve was blown out 4x as much. Both of these points indicate that there is much less leverage in the system driving price up, and there is more organic buying from new market participants.

Love It!