TowerWatch #1: A Return to Normalcy

Welcome to the first edition of TowerWatch, BlockTower’s weekly newsletter! We’ll be delivering TowerWatch on Sunday nights (US Eastern Time), directly to your inbox.

Our goal is simple: be useful.

One: China Goes in on Blockchain

On October 24th the President of China, Xi Jingping, gave a speech to the Political Bureau of the Central Committee that articulated the need for China to ramp up investment into blockchain technology. While he said nothing explicitly about cryptocurrencies, it was made clear that China will be allocating a significant amount of resources and manpower to advancing their blockchain capabilities over the coming years.

Over the following 24 hours the cryptocurrency markets went wild, with Bitcoin experiencing its third largest daily swing ever, rising 42% from $7,361 to $10,370 in 24 hours. Chinese-focused coins in particular saw gains reminiscent of 2017, with both ONT and NEO posting three day gains of 42% and 65% respectively. Much has been made of this price action, with many rumors flying about a sudden influx of Chinese investment.

On the margin, this is a straightforward, bullish announcement. Estimates of the number of Bitcoin users generally range from 20 to 30 million unique holders. With this announcement the word blockchain will eventually be disseminated to over 1 billion people. There is likely to be some percentage (however small) of people who go from hearing the word blockchain to learning about Bitcoin (the largest current application of blockchain tech), and from there, some percentage who end up buying Bitcoin. There is a similar argument to be made for Libra being a bullish event for Bitcoin. General awareness is the first step towards growth.

There are second and third order effects to a statement like this. This push forward from the Chinese might end up causing the United States to allocate more resources to blockchain technology, and become marginally less resistant to the idea of a digital currency.

China has already released plans for a state-sponsored digital currency and the U.S currently doesn’t have a response (save for Libra, which is currently under scrutiny). The dollar is a major source of power for the U.S government making it important for the US to keep the dollar based trade system that most of the world currently operates on. It’s possible that the impending threat from a Chinese digital currency will push United States to be less critical of Libra.

Stay alert: With narrative shifts like this, rumors often begin swirling. For example, there was a widely passed around tweet that claimed to be a picture of an “approved” Chinese cryptocurrency exchange. If this were true, it would have been a very positive signal for the space, but it turned out to be at best overhyped and at worst totally debunked.

An overheated market could also lead to crackdown from China. If this news does end up driving Chinese individuals to purchase cryptocurrencies and push up prices, it could lead to more scrutiny from regulators and a higher probability of government action against cryptocurrencies and exchanges.

Last thought: Generally, the cryptocurrency markets tend to seek narratives. The story that the market tells itself becomes an integral part of the price action and can be used by market participants to justify positions. In an asset as momentum driven as Bitcoin, it becomes important to identify these narratives as they take hold. One of the most important things an investor can do is identify and take advantage of narratives in their infancy.

When we were trading at $7,400 after falling down from $10,000, many were bearish not only because of the price action but also because no one could see a reason for new buyers to step in at the $7,400 level. If everyone was a bear, why would new money wait to buy in lower? Well, as it turned out, the Chinese announcement offered up significant ammunition to the Bitcoin bulls. Whether or not Chinese retail was buying it, the narrative of the potential involvement of Chinese retail was enough to convince buyers to push the price the higher.

Two: The Rise of Institutional Exchanges

At the beginning, all cryptocurrency exchanges existed in a state of legal limbo due to ambiguous laws surrounding the regulation of cryptoassets. As the market grew over the years, regulators started paying more attention and the laws crystallized and clarified. Exchanges in the U.S must now comply with a variety of newly enforced standards. Many exchanges abroad have now chosen to block U.S customers from their offerings rather than comply. Due to this shifting landscape, a schism has appeared between the U.S regulated and offshore entities — and has presented an opportunity for individuals who have worked in the traditional exchange world, who already know the ins and outs of exchange regulation.

There are a variety of U.S based exchanges competing for the title of the worlds best regulated exchange, including the CME, SeedCX, Bakkt and ErisX. All have approached the market with the premise that adhering to regulation is the underpinning for capturing the long term market. To me, the validity of premise remains unclear.

These exchanges certainly have to be playing the long game — seeing as non-U.S entities such as CoinFLEX, Binance and FTX have managed to garner huge volumes and revenues while walling off U.S customers. What’s unclear is whether is will be difficult for those non-U.S entities to enjoy continued success.

The core way for these exchanges to compete right now is through the courting of institutional clients. The CME has done a reasonably good job so far, and has seen their Bitcoin futures market grow significantly Q/Q. SeedCX, ErisX and Bakkt have not yet seen the success of the CME, but in fairness are much younger. Innovation is still happening on the product level. The CME recently revealed their intention to begin Bitcoin options trading, and Bakkt countered a week later with their own announcement of options.

Image Source: CME Group

The important bit: There is a coming rift between regulated, U.S based exchanges and offshore exchanges. Slowly but surely, the U.S market is getting walled off from the rest of the cryptocurrency world. It’s not unlikely that this causes large disjointedness and opportunity over the coming years. The coming launch of the Bakkt mobile app has signaled that these U.S based regulated institutions are willing to innovate, and believe they can still move nimbly to capture significant market share. Whether they can effectively do so is yet to be seen.

Three: The Lending Market Grows

Genesis Capital, one of the largest cryptocurrency lending desks just published an in depth report on the state of their book, and there are some great details and charts.

The most interesting takeaway from the report is that Asian borrowing has picked up significantly.

China has been experiencing currency “flight” for a number of years, and the government has been attempting to restrict Yuan transfers out of the country1. Although the Chinese government has attempted to restrict transfers of Yuan directly into Bitcoin, there are still many liquid on-ramps for Yuan into the digital currency ecosystem, through pairs such as Yuan/USDT, localbitcoins (a peer to peer bitcoin transaction site) and transacting directly with miners. Once in the digital currency, getting to USD or another stablecoin is straightforward and we believe this flow of funds is one of the larger drivers of cash demand out of Asia. Additionally, Asia is home to some of the largest bitcoin mining firms in the world. As mining companies become more sophisticated, they can optimize their balance sheets by leveraging BTC holdings for cash financing to pay costs such as electricity.

From a macro perspective, every time a dollar is borrowed against BTC collateral, the cash is largely used in one of two use cases: speculation or working capital. Speculation is the simplest, where the cash is borrowed to purchase more BTC and leverage long. An example of a working capital use case is a miner who is generally BTC-rich while cash-strapped and electing to pay for electricity contracts by leveraging cash financing against his BTC holdings. Ultimately, both use cases are facilitating sell pressure on USD and foreign currencies, increased velocity on USD, and increased liquidity on the bid for BTC.

Why this matters: Understanding geographic flows of capital is key to understanding where buy / sell pressure may come from. Generally, different geographies approach the cryptocurrency markets in different ways, and contextualizing where the large players in the current market structure are coming from can help you paint a better picture of market direction. For example, if a lot of Bitcoin demand is coming from countries with strict capital controls, that may indicate a population with stronger propensity to anchor their holdings than Bitcoin demand coming from countries where the main use case is speculation.

General News:

Reggie Middleton reaches $9.5 million SEC settlement over ICO fraud

Paxos to launch settlement of U.S.-listed equities after SEC's no-action letter

Capital Markets:

Technical News:

Market Outlook:

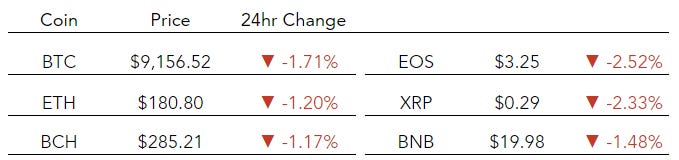

Bitcoin has seen a relatively stable week since the gyrating price action of Oct 24th - 26th. We experienced a blow off top at $10,400, traded down $8,900 shortly after, and have been chopping in the 9,000 - 9400 ever since. BTC has experienced a relatively low daily volatility but a higher amount of intra-day volatility, in a slight return to normalcy for the markets ( We can tell you, last week everyone was going crazy trying to figure out what was going on— this week was far more calm).

Source: BlockTower Calculations, CryptoCompare Data

General Outlook: Within the range, we are currently trading below the midpoint indicating a bearish bias. After the blow off top, we’ve saw a stable increase in spot volumes and an initial drop-off in open interest on derivatives exchanges (the latter of which has slowly been climbing back). The initial rally from 7400 —> 10600 seemed to be a spot driven rally based on large volumes (Delphi Report), indicating that actual buying was taken place. From the 10600 price level, the market has walked down the offer to 9150, with failed pushes past 9700, and more recently 9400. Generally, the stepping down of resistance levels after a large blow-off presents medium term bearish outlook, as it provides evidence that there sellers have stepped down their profit taking. It would not surprise us to see a flush down to 8600. (The previous significant resistance — now support). It’s generally unusually for such a large move to be followed by meek, grind lower price action. This seems to indicate a lack of follow through buying, another data point for the bear case.

Key Levels:

Resistance: 9400, 9700

Support: 9100, 8900, 8600

Overall Market: When evaluating the market, we tend to look for prevailing narratives that may move price. So far, the two potential narratives identified are the “Chinese Narrative” and “DeFi”.

Chinese coins such as NEO, ONT, and TRX have outperformed the rest of the altcoin market, but have now given back a decent amount of their gains. On the DeFi side, Synthetix has performed admirably posting large gains over the last month, but Maker has not — trading mostly sideways. One thing to watch out for is the launch of multi-collateral DAI, which the Maker team is planning on introducing on November 18th.

Correlations have also broken down over the last 30 days, with many coins showing idiosyncratic performance.

Source: BlockTower Calculations, CryptoCompare Data

What We’re Thinking:

Central Banks & Bitcoin

The last few years have seen the rise of negative interest rates, currency wars and trade wars, sparking renewed interest from the general population regarding the role of central banks in the world economy.

We’d like to explore the role of Bitcoin in this discussion by looking (briefly) at the potential economic impact of Bitcoin on the world economy.

Generally, central banks have a turbulent relationship with Bitcoin and digital assets more generally. There has been a significant amount of research output concerning the role of central banks in a world with digitally issued currencies, mainly surrounding the question of whether a central bank should directly issue a digital currency of its own. Research on Bitcoin specifically is more rare. It seems that a simple way to frame the question is, “should there be a free market for currencies?” Economists seem to be equally fascinated and dismissive of a free market currency. It presents a terrifying but intriguing possibility — can a world exist with an unmanaged currency?

The answer to most central banks is a resounding of course not because the idea of a free market currency undermines the entire point of a central bank. Central banks exist to manage state currencies and to ensure that economies run smoothly throughout times of turbulence. If there exists no entity to manage currency supply then the ability to influence economic output doesn’t exist.

This idea that a digital asset cannot usurp the place of a central bank hinges on three things that these banks offer:

Protection against the risk of structural deflation

The ability to respond flexibly to temporary shocks to money demand and thus smooth the business cycle

Capacity to function as a lender of last resort.

Let’s take the third point and run it in a different direction. While central banks may be able to act as a “lender of last resort” in a liquidity crisis, we’d like to talk about the concept of a “currency of last resort”.

A currency of last resort is important for those people trapped in a governmental crisis rather than a liquidity crisis. When you hold your nation’s currency, you are implicitly trusting the government and banking system with full faith to manage the affairs of your country. If they fail to implement effective monetary policy, then you as a citizen and holder of the currency bear a massive cost.

If you believe there is a slight chance that your central bank will not manage the economy effectively, then it’s in your best interest to hold a currency that is not impacted by your state. It’s your hedge. It’s your currency of last resort. If you live in a country with a 1% chance of failure, you should rationally hold some percentage of your savings in assets not tied to that country. The percentage of uncorrelated assets that you hold should scale along with your assessed probability of currency failure.

In the world economic system, it’s important for an asset like this to exist as it will offer the ability to stabilize crises. Central banks do not fail out of nowhere, you can generally see the warning signs. Bitcoin will allow those people living in precarious economic situations to reduce their exposure to their national currency and in the case of total collapse they will not be as negatively impacted, allowing for a faster rebuilding of societal structure.

It doesn’t matter too much if Bitcoin (or another cryptocurrency) replaces central banks. What matters is that the existence of Bitcoin provides a useful currency of last resort for people to store wealth when they believe there could be a potential crisis on the horizon. While there is only scant evidence of Bitcoin acting in this capacity yet, it’s not too far-fetched to believe that a free market, apolitical currency would be a good fit for the role.